Estimating the Effects of Wind Loss Mitigation on Home Value

- December 12th, 2023

- in Uncategorized

Thirty-five catastrophic hurricanes have caused more than $341 billion (in real 2021 dollars) of insured losses along the east coast and gulf coast of the United States since 1999.1 During the same period, coastal property homeowners’ insurance rates in the U.S have increased substantially. Nonetheless, population growth in coastal areas has consistently outpaced that of inland areas, resulting in skyrocketing property value that is exposed to hurricane risk. Large value at high risk caused a decrease in the availability and affordability of property and casualty insurance. For example, the insurance premium for a house in Gulf Shores, Alabama (the city in our sample that is closest to the coast) is 3.15 times greater than that of an identical house in Huntsville, Alabama (the major city in Alabama furthest from the coast). For houses at the coast, the wind portion of insurance premiums is about 80% of total premium.2

Given the location of a house, the only way to decrease the probability and/or severity of a hurricane loss, and thereby reduce the insurance premium, is to install loss mitigation features. Toward this end, the Insurance Institute for Business and Home Safety (IBHS)3 offers the FORTIFIED Home™ (henceforth “Fortified”) program to promote construction of homes that are resilient to natural disasters. Fortified is a set of engineering and building standards designed to strengthen new and existing homes through system-specific building upgrades. The Fortified houses we consider in this study are built to mitigate wind and wind-driven water damage from hurricanes. In addition to promulgating construction standards, IBHS also trains contractors and evaluators to build and inspect houses to meet the standards. A trained and certified evaluator must inspect the house at several specific points in the building process for a house to receive the Fortified designation.

State law requires insurance companies in Alabama to give discounts for houses that earn the Fortified designation.4 There are three levels of Fortified designation: Bronze, Silver, and Gold. The differences in these levels are explained at the IBHS website.5 Table 1 presents benchmark discounts for each level prescribed by the Alabama Department of Insurance. These discounts only apply to the wind portion of a homeowner’s insurance premium. While insurers may offer larger discounts, they may not offer discounts smaller than the benchmark levels.

TUSCALOOSA, Ala. – Dr. Lars Powell, director of the Alabama Center for Insurance Information & Research (ACIIR), and Dr. Boyi Zhuang, an associate research professional at the ACIIR, presented on the riskiness of distracted driving at the 2022 Risk Theory Society Seminar on Saturday, May 21, 2022, at Baylor University.

TUSCALOOSA, Ala. – Dr. Lars Powell, director of the Alabama Center for Insurance Information & Research (ACIIR), and Dr. Boyi Zhuang, an associate research professional at the ACIIR, presented on the riskiness of distracted driving at the 2022 Risk Theory Society Seminar on Saturday, May 21, 2022, at Baylor University.

TUSCALOOSA, Ala. – Shane Crawford successfully defended his dissertation, “Econometric Modeling Framework for Measurement of Resilience Dimensions and Enhanced Spatiotemporal Data Collection Tools to Support Resilience Models,” in August and will officially graduate in December with a doctorate in civil engineering. He has accepted a post-doctoral research position at Colorado State University in Ft. Collins where he will work for roughly four months before moving to the National Institute of Standards and Technology to work as a post-doctoral researcher.

TUSCALOOSA, Ala. – Shane Crawford successfully defended his dissertation, “Econometric Modeling Framework for Measurement of Resilience Dimensions and Enhanced Spatiotemporal Data Collection Tools to Support Resilience Models,” in August and will officially graduate in December with a doctorate in civil engineering. He has accepted a post-doctoral research position at Colorado State University in Ft. Collins where he will work for roughly four months before moving to the National Institute of Standards and Technology to work as a post-doctoral researcher. Crawford’s dissertation focused on filling the gap in resilience measurement science and defining the standards that researchers use to determine recovery. He helped develop a way to take a theoretical resilience curve that has been used in previous literature and applied numbers to it that created empirical curves for Tuscaloosa post-2011 tornado. He then used econometric models, a form of regression analysis, to correlate characteristics of the community with those measurements.

Crawford’s dissertation focused on filling the gap in resilience measurement science and defining the standards that researchers use to determine recovery. He helped develop a way to take a theoretical resilience curve that has been used in previous literature and applied numbers to it that created empirical curves for Tuscaloosa post-2011 tornado. He then used econometric models, a form of regression analysis, to correlate characteristics of the community with those measurements. The Alabama Center for Insurance Information and Research funded Crawford’s assistantship to further drive the center’s mission to fund and participate in research relating to improving insurance conditions for Alabama residents. Catastrophe research like Crawford’s will help inform future building codes and construction standards to lessen the effect of natural disasters on the state’s infrastructure. This will lessen the impact on insurance companies and reduce the risk of rate increases.

The Alabama Center for Insurance Information and Research funded Crawford’s assistantship to further drive the center’s mission to fund and participate in research relating to improving insurance conditions for Alabama residents. Catastrophe research like Crawford’s will help inform future building codes and construction standards to lessen the effect of natural disasters on the state’s infrastructure. This will lessen the impact on insurance companies and reduce the risk of rate increases.

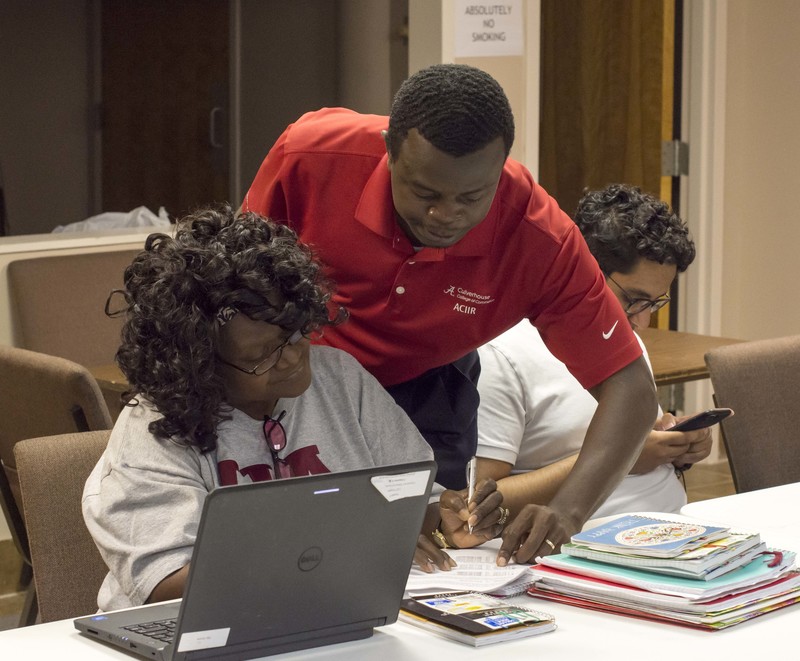

The Alabama Center for Insurance Information and Research began partnering with the Culverhouse LIFT program in 2017 to help advance the goals of both the center and the program. ACIIR researchers and LIFT Founder and Director Lisa McKinney work together to identify and recruit survey participants for an ongoing analysis of insurance and financial literacy in adult populations through the courses offered by the LIFT program.

The Alabama Center for Insurance Information and Research began partnering with the Culverhouse LIFT program in 2017 to help advance the goals of both the center and the program. ACIIR researchers and LIFT Founder and Director Lisa McKinney work together to identify and recruit survey participants for an ongoing analysis of insurance and financial literacy in adult populations through the courses offered by the LIFT program.

“Partnering with LIFT offers us a great opportunity to fulfill our center’s educational and outreach purposes,” said Boyi Zhuang, ACIIR post-doctoral researcher who works directly with the LIFT program. “The surveys we did before and after the training provide us some valuable data that is beneficial to the center’s research.”

“Partnering with LIFT offers us a great opportunity to fulfill our center’s educational and outreach purposes,” said Boyi Zhuang, ACIIR post-doctoral researcher who works directly with the LIFT program. “The surveys we did before and after the training provide us some valuable data that is beneficial to the center’s research.”

The Capstone College of Nursing organized an interprofessional research breakfast in Capstone Village on April 5 to highlight the ongoing work of the ACIIR. Dr. Lars Powell was asked to speak before the group of twenty nursing undergraduate and graduate students as well as administration from the College of Nursing and representatives from the College of Commerce.

The Capstone College of Nursing organized an interprofessional research breakfast in Capstone Village on April 5 to highlight the ongoing work of the ACIIR. Dr. Lars Powell was asked to speak before the group of twenty nursing undergraduate and graduate students as well as administration from the College of Nursing and representatives from the College of Commerce.